The same loan_id is in both data sets so that loan information in McDash can be merged to individual information in Equifax. The Black Knight-McDash data is the loan information and the Equifax data is information on individual credit records including information on which loans they have. The structure of the data contains two separate datasets. Up-to-date consumer risk scores and leading indicators of mortgage default for all mortgages within McDash allow analysts, modelers and economists to benchmark, identify trends, monitor institutional risk, and evaluate borrower behavior. This powerful combination provides a better understanding of the changing credit health of borrowers on both agency and non-agency mortgages. Please acknowledge the Fama-Miller Center for Research in Finance on all written work for the usage of any data.Įquifax and Black Knight have partnered to offer Credit Risk Insight Servicing-the only analytical solution available that combines anonymous consumer credit data with McDash Loan Data. If you have any questions or concerns, please contact Marisa Milazzo. To gain access to the data, you will need a Booth user name and password. Access to certain data is provided only to those who are affiliated with Booth and the Fama-Miller Center. The Fama-Miller Center acquires and maintains data that is provided strictly for academic research and cannot be used for commercial purposes.

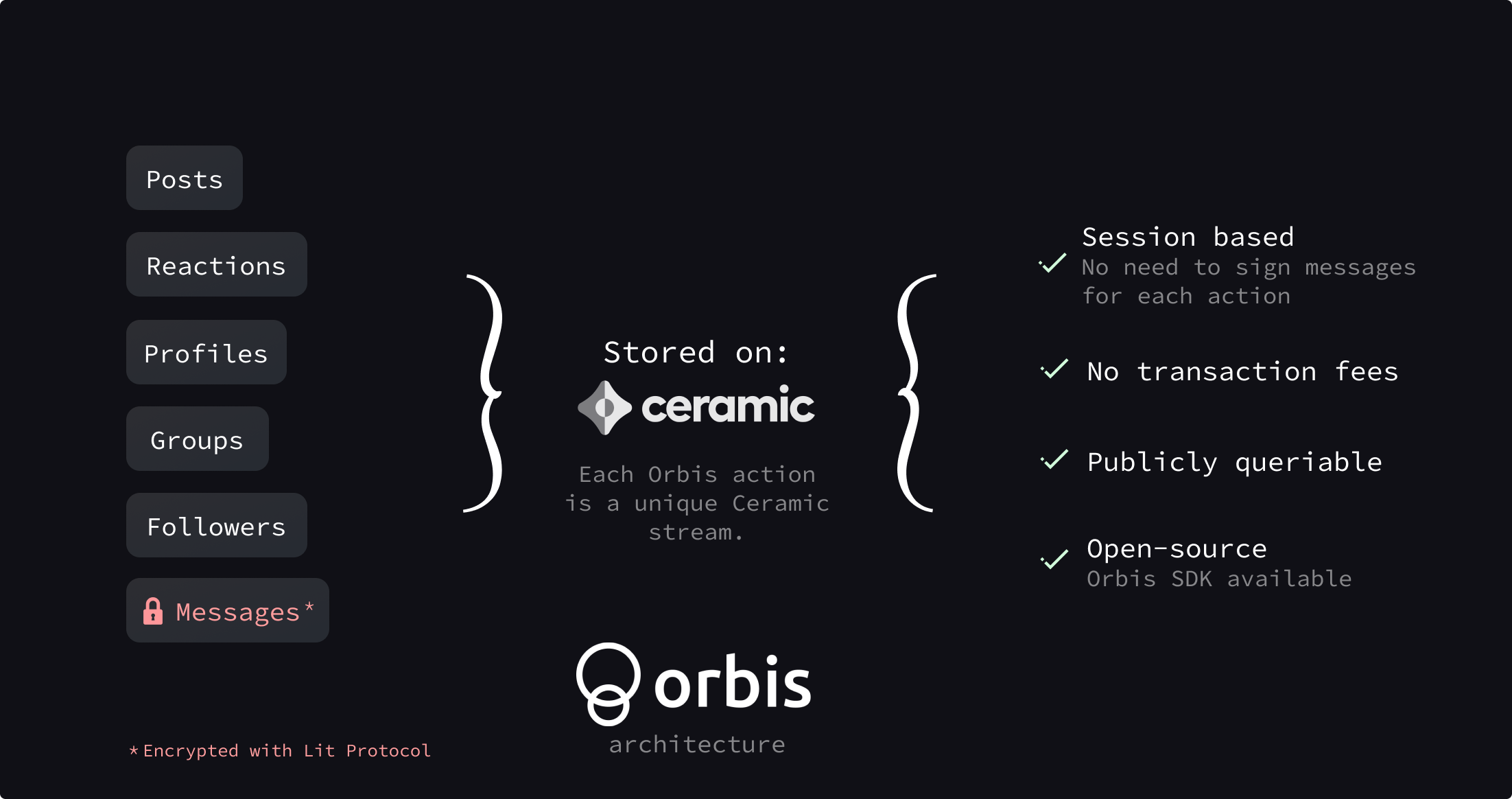

#ORBIS DATASET LICENSE#

Due to license agreements, the use of some data is restricted to the Booth community.

We encourage and support top-quality research through advanced internal infrastructure as well as subscriptions to cutting-edge financial databases.īelow is a list of data funded by the center and available for academic use. The Fama-Miller Center is dedicated to providing the institutional structure and resources necessary to push the boundaries of research in finance.

0 kommentar(er)

0 kommentar(er)